The cost of living in the UK has been at the forefront of the political agenda during most of 2022. The war in Ukraine and ongoing energy challenges were then followed by rising inflation and several sharp rises in interest rates. The Government has intervened on several occasions together with the Bank of England, resulting in widespread concern, especially amongst those who live and work in the Capital.

The cost of living was already a challenge for those living in London before the 2019 pandemic. Prices were on average up to 7% higher in London, compared with elsewhere in the country, and pandemic recovery has also been slower in London compared with other regions. The cost of living crisis has hit London hard, with an estimated 150,000 more Londoners in poverty due to changes in Universal Credit, benefits and tax.

Rental Freeze

In an attempt to help Londoners hit the hardest, the mayor of London, Sadiq Khan, said families would be able to save about Ł3,000 over the next two years if he was given the power to freeze rents in London. Currently, the average rental price in London sits at Ł2,500 (according to Rightmove), and experts predict that this could rise to Ł3,000 per month over the next six months. As the cost of living crisis continues, according to a recent YouGov survey, 40% of Londoners live in fear of rents increasing which will result in renters struggling to maintain payments. It is estimated that 75,000 London households will fall into fuel poverty, adding to the continued struggle.

Currently, 2.6 million people rent privately in London. Sadiq Khan asked the Government in October 2022 to consider rent freezes, stating “The government needs to give us support to build more affordable homes but in the short term, freeze rents.” He told BBC London news. “We need to set up a commission in London, including landlords and tenants, to have a system that works for London. If it’s good enough for Paris and Vienna, why isn’t it good enough for London?”

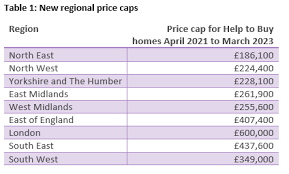

Property Purchases

Given the current amounts that renters pay in the Capital, it is easy to understand why people are choosing to purchase property instead. Those paying Ł2,500 a month or more in rental fees have discovered that mortgage repayments are, in fact, a cheaper option, buy only if they can afford it. Unfortunately, the average property in London is approximately Ł550,000. A hefty deposit of Ł55,000 would be needed, which makes it affordable for only a small percentage of Londoners. Those that are lucky enough to be able to save for a deposit can, of course, arrange mortgages, although with rates rising, this is increasingly challenging. The more money buyers can save, the less they will need to borrow in the long run.

Banks and building societies were historically lending over four times the buyers’ gross annual salary but products are now being changed or withdrawn. If you can secure a mortgage and find your ideal property, firms such as Sam Conveyancing can help with a home buyers survey London, together with the entire conveyancing process.

Sadiq Khan continues with his campaign for rental freezes, but there is no sign the UK Government will introduce them anytime soon.