The Help to Buy scheme was invaluable for a significant number of people trying to grasp a rung on the property ladder. This equity loan scheme could help people to purchase new build properties with small deposits that were as low as 5 per cent. Up to 20 per cent of the home’s price would have been covered by a loan from the government.

This type of arrangement was known as an equity loan, and the value of it would rise or fall with the increase or decrease in the property’s value. The loan would have been paid back when the home was eventually sold.

Popular support

The Help to Buy equity scheme proved popular and nearly a quarter of a million people have taken advantage of it to secure a home that they own. Until 2021, existing homeowners were also able to use it, but from that point on, only first-time buyers could take advantage of this offer. Of course, for anyone participating in a scheme of this type, there is still a mortgage to pay and when they sell the property, they will have to pay back the equity loan too. If you need help with organising your help to buy repayment then it might be worth shopping around and looking at respected conveyancing firms, such as Sam Conveyancing for advice and support.

The help to buy scheme is, however, winding down and is scheduled to come to a close in March 2023 unless the government chooses to extend it. The help to buy ISA was another financial product helping people to purchase their own homes, although this closed to new entrants in 2019. However, account holders who already have their ISA can continue to use it, although there is a deadline for their first purchase bonus of 25 per cent. If holders of a help to buy ISA want to qualify for their first home purchase bonus, which will be paid when the sale of a first home is completed, then they must have bought a property by December 1, 2030.

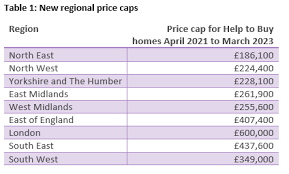

Changes and regional caps

Regional value caps were introduced in 2021. These meant that ceiling price caps would vary, depending on which region you’re in, and the scheme could only be used for purchasing homes below a certain price. However, in more than 20 local authorities, the average price of a new home can easily exceed the regional price cap which means many potential buyers could be excluded from the scheme. In places such as London, the regional price cap can restrict choices and unscrupulous developers can also use it to inflate prices as seen in this report in The Guardian.

One of the criticisms of the help to buy scheme is that it has helped to inflate the cost of new build properties, so not everyone will be sorry to see it end. Some people felt too many property developers benefited from the scheme. Another criticism was that the scheme only applied to new build properties, which excluded a wide range of buyers. While there’s no replacement for help to buy yet, there is a replacement for the help to buy ISA, which is called the Lifetime ISA.